Business Insurance in and around Memphis

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

- East Memphis

- Germantown

- Midtown Memphis

- Collierville

- Cordova

- Bartlett

- Cooper-Young

- Downtown Memphis

- Arlington

- Olive Branch

- Atoka

- Southaven

- Millington

- Lakeland

- Covington

- Rossville

- Piperton

- Oakland

- Brighton

- Munford

- Walls

- Tunica

- West Memphis

- Central Gardens

Your Search For Great Small Business Insurance Ends Now.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Catastrophes happen, like an employee gets hurt on your property.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Surprisingly Great Insurance

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like worker's compensation for your employees or extra liability, that can be molded to develop a personalized policy to fit your small business's needs. And when the unexpected does occur, agent Kathy Thurmond-Edwards can also help you file your claim.

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent Kathy Thurmond-Edwards today to investigate your business insurance options!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

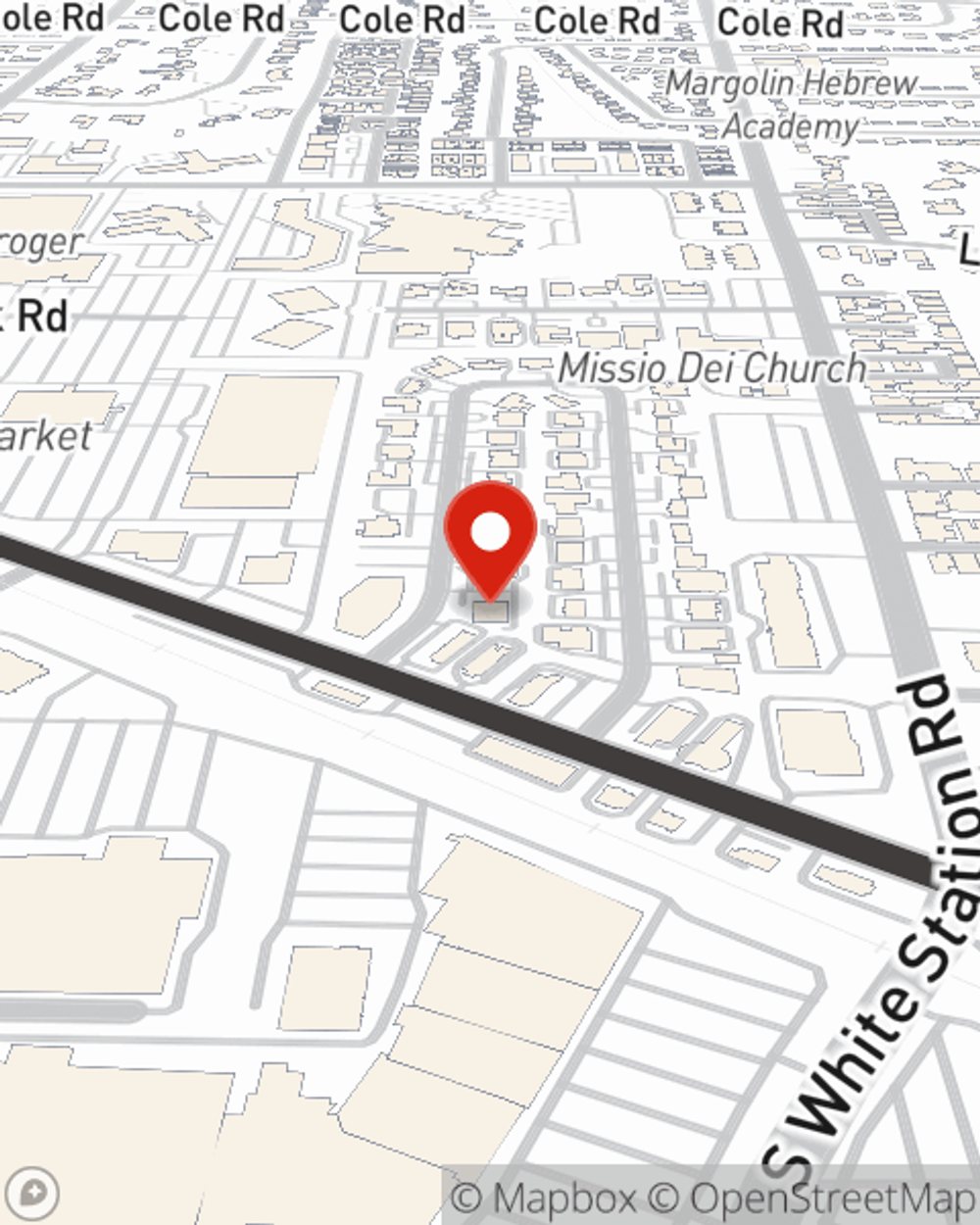

Kathy Thurmond-Edwards

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.